Electric vehicles are becoming increasingly established, not only in China but also in Europe. The largest manufacturer of environmentally friendly cars, BYD, sold more than 341,000 electric cars and plug-in hybrids in June, a new record. This is 35 percent more than in June 2023. And not only vehicles, but also special work vehicles are becoming electric. For example, a new electric excavator made in China for the European market is already being eagerly ordered. Because it is in no way inferior to its fossil-fuel-powered colleagues.

Electricity production from renewable energies is also making progress in this country. In the first six months of 2024, 58% of electricity was generated in an environmentally friendly way. That is also a new record. In the first half of 2023, the figure was 52 percent. Photovoltaic systems are primarily responsible for this, but wind and hydropower are also making strong gains. Storage systems play a major role here. Storage batteries are used in vehicles, but also in electricity production in the form of lithium-ion batteries.

Since April 2023, when the last nuclear reactors in Germany were taken off the grid, nuclear power no longer supplies electricity here. However, other countries are relying heavily on nuclear energy. This can be seen in the number of nuclear power plants planned and under construction. These need uranium and the steep rise in the price of this raw material shows just how much uranium is in demand. Five years ago, a pound of uranium cost around 24 US dollars; today it is more than 85 US dollars. Companies with battery metals such as Green Bridge Metals and uranium companies such as Cosa Resources should be in a good position in terms of demand for these materials.

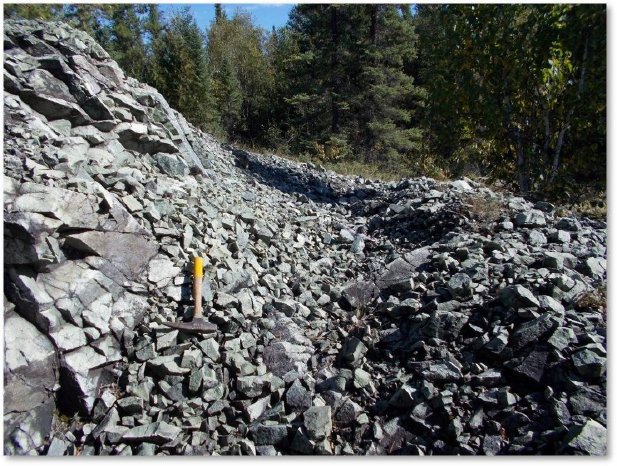

Cosa Resources - https://www.commodity-tv.com/ondemand/companies/profil/cosa-resources-corp/ - owns several uranium projects (209,000 hectares) in the well-known Athabasca Basin in Saskatchewan.

Battery metals are the business of Green Bridge Metals - https://www.commodity-tv.com/ondemand/companies/profil/green-bridge-metals-corp/ . The company is busy exploring projects (copper, nickel, platinum metals) in Minnesota and Ontario.

Current company information and press releases from Green Bridge Metals (- https://www.resource-capital.ch/en/companies/green-bridge-metals-corp/ ) and Cosa Resources (- https://www.resource-capital.ch/en/companies/cosa-resources-corp/ -).

In accordance with §34 WpHG I would like to point out that partners, authors and employees may hold shares in the respective companies addressed and thus a possible conflict of interest exists. No guarantee for the translation into English. Only the German version of this news is valid.

Disclaimer: The information provided does not represent any form of recommendation or advice. Express reference is made to the risks in securities trading. No liability can be accepted for any damage arising from the use of this blog. I would like to point out that shares and especially warrant investments are always associated with risk. The total loss of the invested capital cannot be excluded. All information and sources are carefully researched. However, no guarantee is given for the correctness of all contents. Despite the greatest care, I expressly reserve the right to make errors, especially with regard to figures and prices. The information contained herein is taken from sources believed to be reliable, but in no way claims to be accurate or complete. Due to court decisions, the contents of linked external sites are also co-responsible (e.g. Landgericht Hamburg, in the decision of 12.05.1998 - 312 O 85/98), as long as there is no explicit dissociation from them. Despite careful control of the content, I do not assume liability for the content of linked external pages. The respective operators are exclusively responsible for their content. The disclaimer of Swiss Resource Capital AG also applies: https://www.resource-capital.ch/en/disclaimer/